AI-Powered Multi-Agent System for Financial Fraud Detection

Challenge

A leading fintech aggregator and valued client of Recurrent Software, serving top Banking and Financial Institutions, faced critical challenges in fraud investigation due to their reliance on manual, time-consuming processes for reviewing alerts, identifying similar fraud patterns, and analysing complex transaction data spread across multiple systems. Traditional workflows were highly fragmented—forcing investigators to switch between multiple tools, manually correlate data from disparate sources, and rely heavily on experience-based pattern recognition. This resulted in inconsistent analysis quality, delayed investigation cycles, increased false positive rates, and a heightened risk of missing sophisticated fraud schemes spanning multiple accounts or extended time periods.

Solution

Recurrent Software implemented a comprehensive AI-powered fraud investigation platform for its client, built on a multi-agent architecture that revolutionizes how financial crime analysts in banking and financial institutions conduct investigations. The platform offers an intelligent workspace where investigators can engage conversationally with their data, automatically identify similar fraud patterns, and receive clear, AI-generated analysis explanations. By combining specialized AI agents with advanced data processing capabilities, the solution enables faster, more accurate, and highly consistent fraud detection and investigation, significantly improving both efficiency and reliability.

Below are key capabilities of Multi-Agent Fraud Investigation System:

Conversational Data Exploration – Chat-based interface enabling investigators to query and analyze transaction and account data quickly and intuitively.

Automated Similarity Detection – Uses vector-based matching to detect links between current cases and historical fraud patterns, accelerating investigation speed. .

AI-Powered Fraud Analysis – Generates intelligent, detailed explanations of fraud indicators and risk trends, helping investigators make informed decisions faster. .

Dynamic Data Transformation – Delivers real-time data manipulation and feature engineering, allowing analysts to refine and adapt datasets during investigations. .

Contextual Workspace Management – Employs memory-enabled planning to retain investigation context, streamline workflows, and maintain analytical continuity. .

Outcome

The multi-agent system significantly enhanced both the efficiency and accuracy of fraud investigations. Automated data retrieval and analysis reduced investigation time by 60%, while AI-driven pattern recognition and similarity analysis improved fraud detection accuracy by 40%. The conversational interface removed the need for complex query writing, allowing analysts to focus on high-value investigative work instead of manual data handling. By identifying similar historical cases and providing clear explanations of fraud patterns, the system delivered more consistent investigation quality, accelerated case resolution, and ultimately strengthened the organization’s fraud prevention capabilities.

Approach

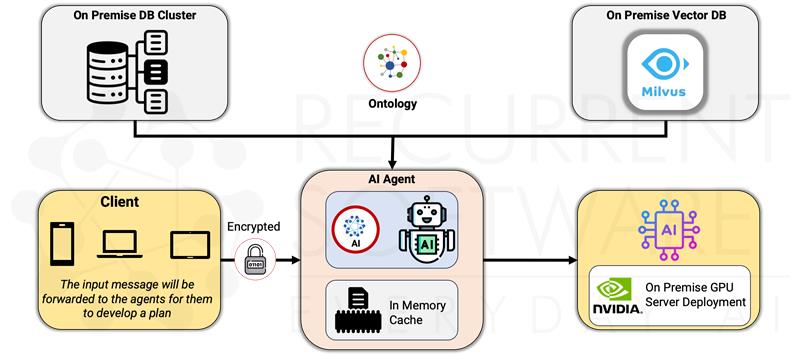

The solution employs a sophisticated multi-agent architecture, where specialized AI agents work in coordination to deliver end-to-end fraud investigation capabilities. Each agent is purpose-built for a specific function: SQL Agents handle data retrieval, Pandas Agents perform data transformations, Analysis Agents generate detailed fraud explanations, Similarity Agents detect patterns through vector databases, and Conversation Agents facilitate user interactions. At the core, a memory-enabled Planner Agent orchestrates the workflow—maintaining workspace context and intelligently routing requests to the appropriate agents. This modular design supports both transaction-level and account-level analysis, leveraging advanced feature engineering to identify complex intra- and inter-transaction patterns.

Technology

Selecting the right tools was crucial to Recurrent Software project's success. Here's our technology stack and the rationale behind each choice:

Multi-Agent Framework:

The system leverages a multi-agent architecture built using Python and RESTful APIs. Specialized agents include SQL for database querying, Pandas for data transformation, and AI-driven agents for fraud analysis, similarity detection, and conversational interaction, all coordinated seamlessly by a Planner agent.

AI Infrastructure:

Powered by scalable vLLM models fine-tuned using LoRA techniques, the AI infrastructure enables real-time inference with custom prompt engineering for each agent. The vector database (Milvus) efficiently stores transaction embeddings for similarity analysis, supported by advanced feature engineering.

Data Management:

The platform integrates with SQL databases for real-time access to core banking systems. Using Pandas, it performs advanced feature engineering and real-time data transformations. Persistent memory ensures investigation context continuity, while Milvus handles high-dimensional fraud pattern storage.

User Interface:

Built with React, the conversational workspace offers a chat-based interface with a canvas layout for intuitive navigation. Dynamic visualizations provide real-time transaction and fraud pattern insights. Users can switch smoothly between transaction and account-level views for comprehensive analysis.

Technical Landscape

Talk to our Expert

Connect with our experts for tailored AI solutions that drive innovation and efficiency. How can we help?

Let'sdiscuss a solutionfor you